Hey there, tax-savvy friend! Are you scratching your head about that mysterious Colorado 1099-G tax refund? Don’t worry, you’re not alone. Thousands of Coloradans face the same head-scratcher every year. Whether you’ve received a 1099-G form or just heard about it, this article’s got your back. We’re diving deep into everything you need to know about the Colorado 1099-G tax refund, breaking it down in a way that’s easy to understand and packed with actionable insights. So, buckle up and let’s get started!

Let’s face it—tax season can feel like a rollercoaster ride. One minute you’re celebrating a fat refund, and the next, you’re wondering why Uncle Sam took a chunk out of your hard-earned cash. But here’s the thing: understanding your 1099-G form can make all the difference. Whether you’re a first-timer or a seasoned pro, this guide will help you navigate the ins and outs of Colorado’s tax refund process.

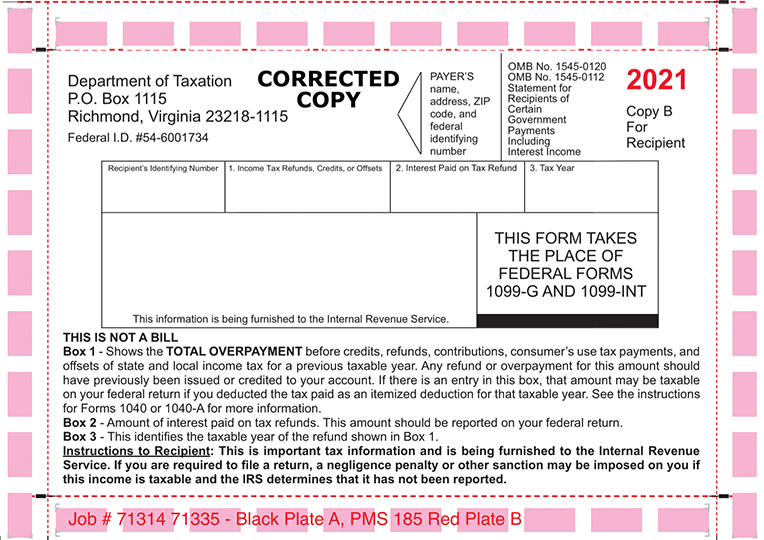

Before we dive into the nitty-gritty, let’s set the stage. The 1099-G form is your golden ticket to understanding where your money went. It’s like a financial breadcrumb trail that shows payments you received from government entities, including unemployment benefits, state tax refunds, and other goodies. Ready to unlock the secrets? Let’s go!

What Is the Colorado 1099-G Tax Refund All About?

Alright, let’s break it down. The 1099-G form is essentially a report card for any payments you received from the government during the tax year. In Colorado, this could include refunds from state income taxes, unemployment compensation, or even agricultural payments. Think of it as the IRS’s way of keeping track of what you got—and what you might owe.

Now, why is this important? Well, if you received a refund from the Colorado Department of Revenue, it could impact your federal tax return. The IRS wants to know if you claimed a deduction for state taxes in a previous year. If you did, and then got a refund, that refund might need to be reported as income on your federal return. Confusing, right? Don’t worry—we’ll simplify it for you.

Who Needs to File a 1099-G in Colorado?

Not everyone gets a 1099-G form, but if you do, it’s worth paying attention to. Generally, you’ll receive one if:

- You received a state tax refund from Colorado.

- You collected unemployment benefits during the year.

- You got agricultural payments or other government disbursements.

For example, if you claimed a $500 state tax refund last year, that amount might show up on your 1099-G. Depending on your situation, it could affect your federal taxes. It’s all about transparency and making sure everything adds up.

Understanding Your 1099-G Form: Key Sections to Watch

Now that we know what the 1099-G is, let’s take a closer look at its key sections. The form might seem intimidating at first, but once you break it down, it’s pretty straightforward.

Box 1: Total Payments

This box shows the total amount of payments you received from the government. For most people in Colorado, this will include their state tax refund. If you got a big refund last year, you’ll see it here.

Box 3: Unemployment Compensation

Got laid off or took a break from work? This box shows any unemployment benefits you received. Keep in mind that unemployment benefits are taxable, so you’ll need to include this amount on your federal return.

Box 16: State Tax Refund

This is where things get interesting for Colorado residents. Box 16 shows the amount of your state tax refund that might be taxable at the federal level. If you claimed a deduction for state taxes in a previous year, this refund could count as income.

How Does the Colorado 1099-G Impact Your Federal Taxes?

Here’s the million-dollar question: How does your 1099-G affect your federal tax return? It depends on your specific situation, but here’s the gist:

If you claimed a deduction for state taxes in a previous year, and then received a refund, that refund might be taxable. For example, let’s say you claimed a $1,000 state tax deduction on your federal return last year. If you later received a $500 refund from Colorado, you’ll need to include part of that refund as income on your federal return.

Confusing? Don’t worry—we’ll walk you through it step by step.

Step 1: Check Your Previous Deductions

Grab your old tax return and take a look at your state tax deduction. Did you itemize deductions? If you did, and you received a refund this year, it might impact your federal taxes.

Step 2: Compare Your Refund to Your Deduction

Now, compare the refund amount on your 1099-G to the deduction you claimed. If the refund is less than or equal to your deduction, you’ll need to include the refund as income on your federal return.

Step 3: Adjust Your Federal Return

Once you’ve figured out the taxable portion of your refund, it’s time to adjust your federal return. You’ll report this amount on Line 21 of Form 1040. Easy peasy, right?

Common Mistakes to Avoid with Your Colorado 1099-G

When it comes to tax forms, mistakes happen. But some errors can cost you big time. Here are a few common pitfalls to watch out for:

- Forgetting to Report Your Refund: If you received a state tax refund, don’t ignore it. Even if it seems small, it could still impact your federal return.

- Overlooking Unemployment Benefits: If you collected unemployment compensation, make sure to include it on your federal return. It’s taxable income, so leaving it off could lead to penalties.

- Not Checking Your Deductions: Double-check your previous tax returns to ensure you’re reporting the correct amounts. A small mistake could snowball into a big problem down the line.

Tips for Maximizing Your Colorado Tax Refund

Now that you know how the 1099-G works, let’s talk about how to make the most of your Colorado tax refund. Here are a few strategies to consider:

1. Save It for a Rainy Day

Got a big refund? Consider stashing it in an emergency fund. Life’s unpredictable, and having a financial safety net can make all the difference.

2. Invest in Your Future

Why not put your refund to work? Whether it’s contributing to a retirement account or investing in stocks, your refund can help grow your wealth over time.

3. Pay Down Debt

Tired of those high-interest credit card payments? Use your refund to knock out some debt. Every little bit helps, and you’ll save money on interest in the long run.

Colorado Tax Laws: What You Need to Know

Colorado has its own set of tax laws, and staying informed can save you a ton of hassle. Here are a few key points to keep in mind:

First, Colorado has a flat income tax rate of 4.55%. That means everyone pays the same percentage, regardless of their income level. Simple, right?

Second, Colorado offers a variety of tax credits and deductions to help residents save money. From energy-efficient home improvements to childcare expenses, there are plenty of opportunities to reduce your tax liability.

State Tax Credits for Colorado Residents

Here are a few popular tax credits available to Colorado residents:

- Child Care Credit: Helps offset the cost of childcare expenses.

- Energy Credits: Rewards homeowners for making energy-efficient upgrades.

- Disaster Relief Credits: Provides relief for those affected by natural disasters.

Where to Get Help with Your Colorado Taxes

Taxes can be overwhelming, especially when you’re dealing with forms like the 1099-G. If you need a hand, there are plenty of resources available:

First, consider working with a certified tax professional. They can help you navigate the complexities of Colorado’s tax laws and ensure you’re getting the maximum refund possible.

Second, don’t forget about free resources like the IRS’s Volunteer Income Tax Assistance (VITA) program. They offer free tax help for low- to moderate-income taxpayers.

Online Tools for Colorado Taxpayers

If you prefer doing it yourself, there are plenty of online tools to help. TurboTax and H&R Block offer user-friendly platforms that walk you through the tax filing process step by step.

Final Thoughts: Making the Most of Your Colorado 1099-G Tax Refund

Alright, we’ve covered a lot of ground. Let’s recap:

First, the 1099-G form is your key to understanding any payments you received from the government. Whether it’s a state tax refund or unemployment benefits, this form keeps everything in check.

Second, Colorado’s tax laws offer plenty of opportunities to save money. From flat income tax rates to generous tax credits, there’s a lot to love about filing taxes in the Centennial State.

Finally, don’t be afraid to ask for help. Whether it’s working with a tax professional or using online tools, there are plenty of resources to make tax season a little less stressful.

So, what’s next? Take a deep breath, grab your 1099-G, and start crunching those numbers. And remember—if you’ve got questions, we’re here to help. Drop a comment below, share this article with your friends, or check out our other tax tips. Together, we’ll make tax season a breeze!

Table of Contents

- What Is the Colorado 1099-G Tax Refund All About?

- Who Needs to File a 1099-G in Colorado?

- Understanding Your 1099-G Form: Key Sections to Watch

- How Does the Colorado 1099-G Impact Your Federal Taxes?

- Common Mistakes to Avoid with Your Colorado 1099-G

- Tips for Maximizing Your Colorado Tax Refund

- Colorado Tax Laws: What You Need to Know

- Where to Get Help with Your Colorado Taxes

- Online Tools for Colorado Taxpayers

- Final Thoughts: Making the Most of Your Colorado 1099-G Tax Refund