So, you’ve probably heard the term “Dow futures” being thrown around on financial news channels or maybe your friend mentioned it over coffee. But what exactly are Dow futures, and why should you care? Let’s break it down. Think of Dow futures as a crystal ball for the stock market—well, sort of. These financial instruments can give investors a glimpse into where the market might head before the official trading day begins. If you’re new to the world of finance, don’t worry; we’ll make sure everything makes sense by the end of this article.

Now, you might be thinking, “Why should I care about Dow futures?” Well, if you’re interested in understanding how the stock market works or you’re an investor who wants to stay ahead of the curve, Dow futures are your best friend. They’re not just for Wall Street elites; even casual investors can benefit from knowing what they mean and how they work. Let’s dive in, shall we?

In this article, we’ll explore everything you need to know about Dow futures, from their definition to how they impact the market. We’ll also cover some practical tips so you can use this knowledge to your advantage. So, grab a cup of coffee, sit back, and let’s demystify Dow futures together. Ready? Let’s go!

What Are Dow Futures? The Basics Explained

Dow futures are essentially contracts that represent the value of the Dow Jones Industrial Average (DJIA) before the actual market opens. Think of them as a preview of what’s to come. Investors and traders use these futures to gauge market sentiment and make informed decisions. It’s like reading the tea leaves, but with actual numbers and data.

Here’s the deal: Dow futures are traded on exchanges like the Chicago Board of Trade (CBOT). They’re not tied to individual stocks but rather to the overall performance of the 30 companies that make up the Dow Jones Industrial Average. When people talk about Dow futures, they’re referring to these contracts that allow investors to bet on whether the market will rise or fall.

Let’s put it into perspective. If you see that Dow futures are up before the market opens, it usually means that traders are optimistic about the day ahead. Conversely, if they’re down, it could signal some potential trouble. But remember, Dow futures are just indicators—they’re not guarantees of what will happen once the market officially kicks off.

Why Dow Futures Matter in the Financial World

You might be wondering, “Why do people pay so much attention to Dow futures?” The answer is simple: they provide valuable insights into market sentiment. When traders and investors wake up in the morning, one of the first things they check is the Dow futures. It’s like checking the weather forecast before heading out for the day.

For example, if there’s some major news overnight—like a big company reporting earnings or a geopolitical event—Dow futures can give you a heads-up on how the market might react. This is especially important for traders who need to make quick decisions based on real-time information.

Also, Dow futures aren’t just for big-shot investors. Everyday people who have retirement accounts or stock portfolios can benefit from understanding them. It’s all about staying informed and making smarter financial choices. And let’s face it, in today’s fast-paced world, information is power.

How Dow Futures Impact the Broader Market

Now, let’s zoom out a bit and look at how Dow futures influence the broader market. When Dow futures move significantly, it can create a ripple effect across other financial markets. For instance, if Dow futures are pointing to a sharp decline, it might cause panic among investors, leading to sell-offs in other asset classes like bonds or commodities.

On the flip side, if Dow futures are showing a strong upward trend, it can boost investor confidence and lead to more buying activity. This can drive up prices across the board. It’s like a domino effect, where one market movement can trigger reactions in others.

Another interesting aspect is how Dow futures can impact international markets. Since the U.S. stock market is one of the largest in the world, its movements often have a global impact. If Dow futures indicate a potential downturn, it might cause foreign investors to rethink their strategies or even pull out of certain markets.

Understanding the Mechanics of Dow Futures

Okay, let’s get a bit technical here. Dow futures operate on a system of leverage, which means you can control a large amount of value with a relatively small investment. This can be both a blessing and a curse. On one hand, it allows investors to make big gains with a smaller amount of capital. On the other hand, it also amplifies losses if things don’t go as planned.

Here’s how it works: when you buy a Dow futures contract, you’re essentially agreeing to buy or sell the Dow Jones Industrial Average at a predetermined price on a future date. If the actual value of the Dow moves in your favor, you profit. If it moves against you, well, let’s just say it’s not a great day for your portfolio.

One important thing to note is that Dow futures are cash-settled, meaning there’s no physical delivery of the underlying asset. Instead, the contract is settled based on the difference between the agreed-upon price and the actual price at expiration. This makes them more flexible and easier to trade compared to traditional commodities like oil or gold.

Key Players in the Dow Futures Market

So, who’s driving the Dow futures train? The main players are institutional investors, hedge funds, and professional traders. These folks have access to sophisticated tools and resources that allow them to analyze market trends and make informed decisions. But that doesn’t mean individual investors can’t get in on the action.

Platforms like E*TRADE, TD Ameritrade, and Interactive Brokers offer access to futures trading for retail investors. Of course, it’s important to do your homework and understand the risks involved before diving in. After all, the market can be unpredictable, and futures trading is not for the faint of heart.

And don’t forget about the role of algorithms and automated trading systems. These days, a lot of Dow futures trading is done by computers executing trades at lightning-fast speeds. While this can increase efficiency, it also adds a layer of complexity to the market.

Common Misconceptions About Dow Futures

There are a few misconceptions floating around about Dow futures that we need to clear up. First of all, some people think that Dow futures are only for experienced traders. While it’s true that they can be complex, anyone with a basic understanding of the stock market can learn how to use them effectively.

Another myth is that Dow futures always accurately predict the market’s movement. Sorry, folks, but no crystal ball is perfect. While Dow futures can provide valuable insights, they’re not a guarantee of what will happen once the market opens. There are always other factors at play, like unexpected news or sudden changes in market sentiment.

Lastly, some people believe that Dow futures are only relevant to U.S. investors. Wrong again! As we mentioned earlier, the global financial markets are interconnected, so what happens in the U.S. can have ripple effects around the world. Even if you’re an investor based in Asia or Europe, keeping an eye on Dow futures can help you stay ahead of the curve.

Breaking Down the Numbers: How to Read Dow Futures

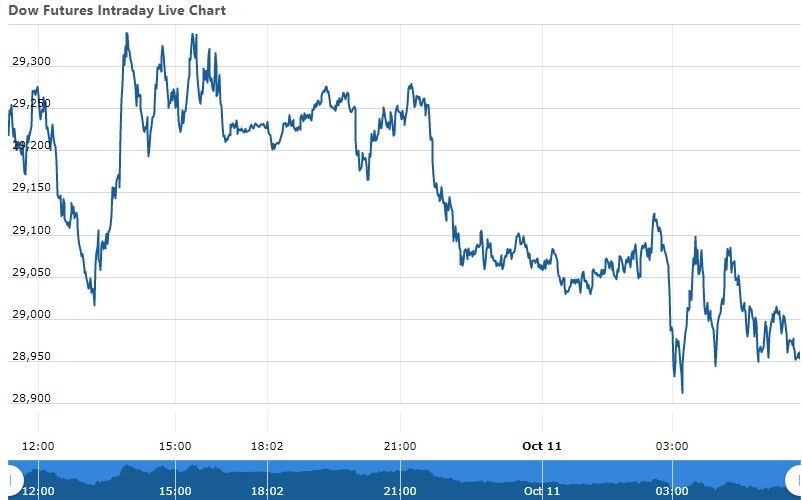

Now that we’ve covered the basics, let’s talk about how to read Dow futures. When you see a report saying that Dow futures are up 100 points, it means that the value of the futures contract has increased by that amount compared to the previous day’s close. Simple, right?

But here’s where things get interesting. Each point in the Dow represents $1, so a 100-point increase in Dow futures is equivalent to a $100 gain per contract. Of course, this doesn’t mean you’ll automatically make $100; it depends on the size of your position and other factors like fees and commissions.

Another important metric to watch is the spread between Dow futures and the actual Dow Jones Industrial Average. If the spread is wide, it could indicate some uncertainty or volatility in the market. On the other hand, a narrow spread might suggest that traders are feeling more confident about the day ahead.

How to Use Dow Futures in Your Investment Strategy

If you’re thinking about incorporating Dow futures into your investment strategy, there are a few things to keep in mind. First, make sure you have a solid understanding of how they work and the risks involved. It’s not a game of roulette; it requires careful planning and analysis.

One popular strategy is to use Dow futures for hedging. Let’s say you have a portfolio of stocks that you’re worried might decline in value. You could buy a Dow futures contract as a form of insurance, essentially betting against your own portfolio. If the market does go down, your futures position could offset some of the losses.

Another approach is to use Dow futures for speculation. This involves taking a position based on your expectations of where the market will go. For example, if you think the market is due for a rebound, you could buy a Dow futures contract to capitalize on the potential upside. Just remember, speculation comes with its own set of risks, so proceed with caution.

Risk Management in Dow Futures Trading

Speaking of risks, let’s talk about how to manage them when trading Dow futures. One key strategy is to use stop-loss orders, which automatically close your position if the market moves against you by a certain amount. This can help limit your losses and protect your capital.

Another important tool is diversification. Don’t put all your eggs in one basket, especially when it comes to futures trading. Spread your investments across different asset classes and markets to reduce your exposure to any one particular risk.

Finally, make sure you have a solid risk management plan in place. This includes setting clear goals, defining your risk tolerance, and sticking to your strategy even when the market gets volatile. Remember, the goal is to make smart, informed decisions, not to chase quick profits.

Real-World Examples of Dow Futures in Action

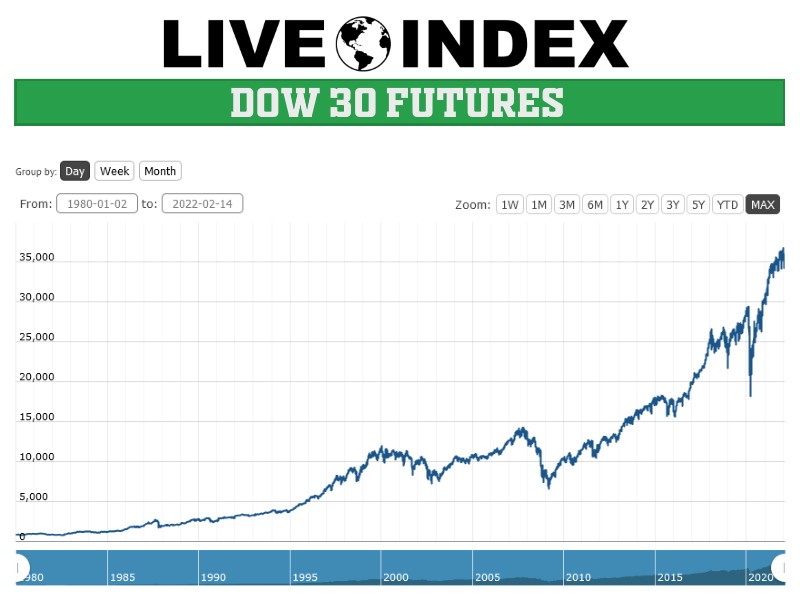

To help illustrate how Dow futures work in the real world, let’s look at a couple of examples. Back in 2008, during the financial crisis, Dow futures were a key indicator of the market’s turmoil. As news of the housing market collapse spread, Dow futures plummeted, signaling a potential meltdown in the broader market. This, in turn, led to widespread panic and a sharp decline in stock prices.

Fast forward to 2020, during the early days of the pandemic, Dow futures were once again in the spotlight. As the world grappled with the uncertainty of lockdowns and economic shutdowns, Dow futures provided valuable insights into market sentiment. When they started to recover, it signaled a potential turning point in the global economy.

These examples show just how powerful Dow futures can be as a market indicator. They don’t just reflect what’s happening right now; they can also give us a glimpse into what might happen in the future. And in the world of finance, that kind of foresight is invaluable.

Lessons Learned from Historical Dow Futures Movements

Looking back at historical movements in Dow futures, we can learn a lot about how the market works and how to navigate its ups and downs. One key lesson is the importance of staying informed. Whether it’s a financial crisis or a global pandemic, staying up-to-date on the latest news and trends can help you make better investment decisions.

Another takeaway is the value of patience. Markets can be volatile, especially in times of uncertainty, but history has shown that they tend to recover over the long term. By focusing on the big picture and avoiding knee-jerk reactions, you can position yourself for long-term success.

And finally, don’t underestimate the power of diversification. Whether it’s through Dow futures or other investment vehicles, spreading your risk across different assets and markets can help protect your portfolio from unexpected downturns.

Final Thoughts: Why Dow Futures Are Worth Your Attention

As we wrap up this deep dive into Dow futures, let’s recap what we’ve learned. Dow futures are a powerful tool for understanding market sentiment and making informed investment decisions. They provide valuable insights into where the market might be headed and can help you stay ahead of the curve.

Whether you’re a seasoned investor or just starting out, understanding Dow futures can give you a competitive edge in the world of finance. Just remember to do your research, manage your risks, and stay patient. After all, success in the markets isn’t about getting rich quick; it’s about building wealth over time.

So, what’s next? If you found this article helpful, feel free to leave a comment or share it with your friends. And if you’re ready to take your investment strategy to the next level, why not explore some of our other articles on financial topics? The more you know, the better equipped you’ll be to navigate the ever-changing world of finance. Good luck, and happy investing!

Table of Contents